Efficient GST Registration and Filing Solutions for Businesses in Singapore

With over a decade of experience, our team of GST specialists is well-versed in the latest rules and regulations. We stay abreast of all changes to Singapore’s GST system to ensure your business stays compliant.

Hassle-free

A hassle-free GST registration process with accurate classifications and tax codes to minimize your GST liabilities

Stay Compliant

Ensure tax compliance and steer clear of penalties

Promptly

Ensuring the timely filing of your GST F5 and F7 returns

Continuous Excellence

Ongoing GST optimization and advisory

Frequently Asked Questions

GST, or Goods and Services Tax, is a consumption tax in Singapore. Businesses with an annual taxable turnover exceeding S$1 million are required to register for GST.

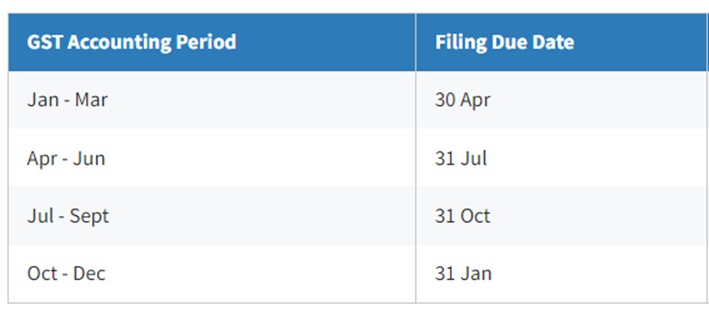

GST returns and payment are due one month after the end of the accounting period covered by the return.

IRAS may take the following enforcement actions if you fail to file by the due date:

- Issue an estimated Notice of Assessment and impose a 5% late payment penalty on the estimated tax

- Impose a late submission penalty

- Summon the business or persons responsible for running of the business (including the sole-proprietor, partner and director) to Court

To seek expert advice, ensuring timely filing, promptly issuing tax invoices, and maintaining proper GST records. Our comprehensive GST services offer end-to-end support in these critical areas.

The current GST rate in Singapore is 9%.

Get started with compliant GST filing.

Still struggling with complex GST paperwork? Our dedicated team makes compliance easy so you can focus on growing your business.